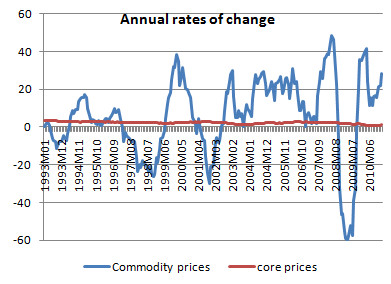

It is almost conventional wisdom that commodity (particularly oil now) "

price shocks

" or spikes have an affect on

inflation

. The Chicago Fed has a

new paper (.pdf) that says quite the contrary. For a quick perspective, here is a handy-dandy chart from the

IMF

that tracks the correlation between the two:

H/T -

Paul Krugman